Understanding the VIX: The Market’s Fear Gauge

With commentators talking about the volatility index (VIX) rising, should this cause alarm for investors?

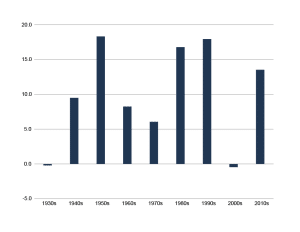

Back in early August, the VIX closed one Friday at 23, and by Monday, it spiked as high as 65. The VIX is a measure of the market’s expectation of volatility over the next 30 days, calculated based on S&P 500 index options. S&P 500 options are financial instruments that investors use to hedge against or speculate on market movements. Generally, the VIX rises when there is greater uncertainty or fear in the market. Although investors can use the VIX to get a sense of the market’s expectation of future volatility, it’s not a statistically significant predictor of market movements. When volatility spikes or the stock market declines, this could be an opportunity to rebalance your portfolio by buying stocks at lower prices. While monitoring the VIX can be useful, it’s important to remain calm during periods of high volatility and stay focused on your long-term goals.

VIX interpretations:

- 0-15: The market is expecting unusually low volatility.

- 15-25: The market is expecting a “normal” amount of volatility.

- 25-30: The market is expecting more volatility than normal.

- 30 and over: The market is expecting some extreme swings.

If you have any questions, please drop us a note.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this information. Please be advised that Buckingham only shares video and content through our website, Facebook, LinkedIn page, and other official sources. We do not post investment advice on WhatsApp, Telegram, other interactive applications, or other similar platforms. Rather, Buckingham provides investment advice only through individualized interactions. R-24-7680.