What Kind of Returns Can You Anticipate from Your Portfolio?

When building an investment portfolio, clients commonly ask what rate of return is reasonable to expect over the long term. Related to that point, clients often wonder why their portfolio’s returns may be different relative to well-known benchmarks, or indexes like the S&P 500. Let’s dig into both.

What rate of return is a fair long-term expectation?

Many investors believe that an appropriate expected return for the broad U.S. stock market is 10% annually based on the long-term average. However, over longer periods of time, the difference between expected returns and actual returns can be substantial, particularly for high-risk portfolios. While staying invested over a longer time helps mitigate this difference, it does not eliminate this investing reality. One can get a sense of this by looking at the decade-by-decade annualized returns of the broad U.S. stock market and comparing it with a 10% expected return.

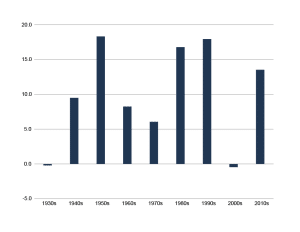

Returns by Decade for the U.S. stock market

Source: Ken French data library, U.S. total market returns series.

Source: Ken French data library, U.S. total market returns series.

The total market return came close to 10% in only two decades – the 1940s and 1960s – and it beat that expectation in four decades. This illustrates one of the primary challenges of investing: Returns can diverge significantly from expectations, even over long periods of time. Nevertheless, investors would be wise not to abandon their well-thought-out investment plan when this happens. A smarter strategy is to design your portfolio to mitigate this risk through broad diversification.

What drives differences in portfolio returns relative to well-known benchmarks?

For investors in well-diversified portfolios, the two main building blocks are high-quality bonds and stocks. Within the stocks category, you’ll not only have exposure to the broad U.S. stock market but also to international and emerging markets. Your portfolio may also have increased exposure to small company stocks and value stocks. That means there are four primary drivers of both expected and realized returns in your portfolio – but a market benchmark like the S&P 500 only captures one of those drivers. Importantly, the returns you earn in either an absolute sense or relative to a market benchmark may be different. Let’s look at the four primary investment categories and what the current indicators of returns are showing:

Returns on high-quality fixed income investments

A good indicator of long-term expected returns on fixed income, or bonds, is the current interest rate, or yield. Understandably, when interest rates are relatively high, as in the 1980s and 1990s, you can expect realized returns on fixed income to be higher. Similarly, you can expect lower returns during periods of low interest rates, like the 2010s. This means that the returns you can expect on fixed income, even over long horizons, can be different depending upon the historical starting point. Currently, we believe sensible long-term expected returns on high-quality fixed income are around 4%per year.

Returns on the broad U.S. stock market

For stocks, providing an estimate is far more complicated. A good place to begin is looking at starting price-to-earnings (P/E) ratios – which you calculate by dividing a stock’s current price by its earnings per share (EPS) – and expected inflation. Generally, investing in stocks when P/E ratios are lower tends to lead to higher long-term returns, as this indicates you are entitled to more earnings and dividends for each dollar invested. However, this relationship can be unpredictable. Currently, the P/E of the broad U.S. stock market is around 25. The long-term average has been around 16, indicating that U.S. stocks are expected to provide lower returns than in the recent past.

Returns on broad international and emerging markets

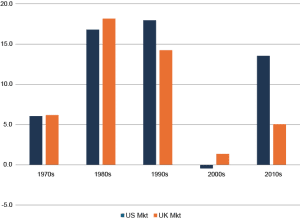

Returns by Decade for the U.S. vs U.K. Stock Market

The chart illustrates that returns can diverge across international markets even over longer periods of time. The way to mitigate this risk is to not concentrate your investments in any single country’s market. Currently, we believe realistic long-term return expectations for a globally diversified stock portfolio are in the 7%–8% per year range.

Returns on value and small company stocks

The final driver of portfolio returns for some investors is whether their stock allocation looks significantly different from the overall global equity market, particularly whether it is tilted toward companies that are smaller and have lower P/E ratios. Over the longer term, we believe these tilts can be incrementally additive to returns. However, this also means that the returns of tilted portfolios will, by definition, be different from the market over both shorter and longer periods of time.

Conclusion

It is important to understand how your portfolio may differ from market benchmarks. For example, the S&P 500, an index tracking the performance of 500 U.S. stocks, likely only provides insight for how a portion of your portfolio is performing. Expected and realized performance of bonds, international stocks and other diversifying investment strategies will be key to setting reasonable expectations. Speak with your wealth advisor if you have questions about your portfolio allocation and whether you’re on track to meet your goals.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. Please be advised that Buckingham only shares video and content through our website, Facebook, LinkedIn page, and other official sources. We do not post investment advice on WhatsApp, Telegram, other interactive applications, or other similar platforms. Rather, Buckingham provides investment advice only through individualized interactions. R-24-7652